19 Apr Cryptocrime To Cost The World $30 Billion Annually By 2025

Scam revenue will grow 15 percent YoY for the next 5 years. Sponsored by Evolution Equity

Melbourne, Australia – Apr. 19, 2022 | Press Release

2022 CRYPTOCRIME REPORT

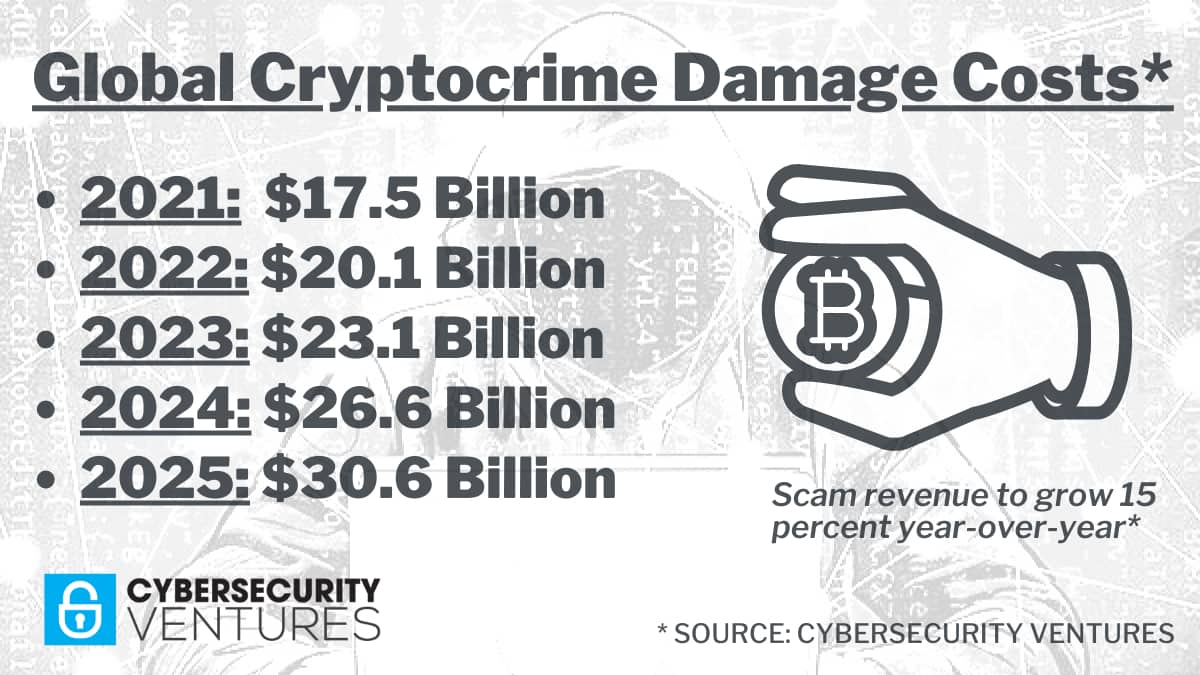

Rapid growth in the use of decentralised finance (DeFi) services is creating a new soft spot for global financial systems, fostering new methods of cryptocrime for cybercriminals whose “rug pulls” and other attacks will, Cybersecurity Ventures predicts, cost the world $30 billion in 2025 alone.

That’s nearly twice the $17.5 bilion lost in 2021 — and expected to grow by 15 percent annually as the cryptocurrency market continues to expand, fueling cybercriminals’ increasing interest in pilfering cryptocurrency stores.

Cybercriminals’ attention to crypto is manifesting in a range of ways, including direct exchange hacks — such as the $30 million theft from Crypto.com in January — and scams designed to trick people into handing over their cryptocurrency holdings for any number of false purposes.

Crypto scammers took $7.7 billion from victims thanks to crypto scams last year alone, reports CryptoSlate — an 81 percent increase compared to 2020 — and the Federal Trade Commission last year noted that losses had increased tenfold over the previous 12 months.

Cybercrime Radio: The latest on cryptocrime

New breed of cryptosecurity companies emerge

Much of the stolen funding ends up being funneled through exchanges, or exchanged for fiat currency, in an attempt to launder it — an approach that, Chainalysis has found, led to the laundering of $8.6 billion worth of cryptocurrency in 2021.

Thankfully, the indelible nature of cryptocurrencies’ blockchain protocol is helping authorities catch up with the criminals — as happened this year, when a New York couple was arrested after trying to launder $4.5 billion worth of cryptocurrency stolen during the 2016 hack of the Bitfinex exchange.

“Criminals always leave tracks, and today’s case is a reminder that the FBI has the tools to follow the digital trail, wherever it may lead,” said FBI Deputy Director Paul M. Abbate as the arrests were announced.

“Thanks to the persistent and dedicated work of our FBI Investigative teams and law enforcement partners, we’re able to uncover the source of even the most sophisticated schemes and bring justice to those who try to exploit the security of our financial infrastructure.”

DeFi moves the goalposts … again

Cryptocurrency overall has had a roller-coaster year already, with the January cryptocurrency crash wiping out $1 trillion in market value.

Yet with a recent FSInsight analysis suggesting that Bitcoin could still break the $200,000 mark by the second half of this year — and Ethereum $12,000 — cybercriminals’ attention to the sector will only continue growing as the potential proceeds of cybercrime continue to increase.

That bodes poorly for emerging sectors such as DeFi, where new vulnerabilities are emerging as cybercriminals exploit innovative financial systems in new ways — with “rug pulls” the latest challenge.

Rug pulls happen when the backers of a cryptocurrency or financial platform suddenly abandon it, running off with the liquidity backing the token and leaving investors in the lurch.

It’s happening more and more often, with Chainalysis noting that last year there were 28 high-profile rug pulls that took in more than $2.8 billion worth of cryptocurrency.

DeFi rug pulls comprised 37 percent of all cryptocurrency scam losses during the year, according to blockchain analytics firm Elliptic, up from just one percent the year before.

Elliptic recently pegged total DeFi losses at over $12 billion since 2020 — including more than $10.5 billion (€9.3b) in 2021 alone.

As investment in cryptocurrency platforms continues to explode — the amount of cryptocurrency stored on DeFi platforms increased from $12 billion in 2020 to $86 billion last year, according to DeFi Pulse — the numbers are only likely to get bigger.

Yet the sector remains highly volatile, with Consensys recently noting that overall market capitalization had dropped from $174 billion last November, to $105 billion at the end of January — when the number of DeFi wallets reached a record 4.3 million.

For market watchers, those numbers suggest a runaway financial revolution — but to cybercriminals, it’s an opportunity.

Even as cybercriminals rub their hands in glee, national governments have responded by shining a legislative light on the cryptocurrency space.

Regulators in the UK, Australia, and elsewhere are floating the prospect of tightening controls on cryptocurrency operators that would, among other things, provide more certainty for investors.

The reforms, as Australian Treasurer Josh Frydenberg said in introducing them, are intended to give consumers “confidence that businesses they engage with to buy, sell or hold digital assets like crypto are subject to appropriate oversight and licensing arrangements.”

“We will improve regulatory certainty for businesses, better protect consumers and investors, and support competition by making it easier for innovative new entrants.”

Cryptosecurity Market

Cyberattacks on crypto exchanges and its users are fueling a market for pure-play “cryptosecurity” companies, according to Cybersecurity Ventures.

The growth in cryptocrime is “directly correlated to the fact that there’s just a lot more money here and that goes with the classic triangle for fraud, manipulation and abuse,” says Chen Arad, co-founder and COO at Solidus Labs, a crypto-native company with offices in Tel-Aviv, Israel, New York City, Washington, D.C., and London.

“There is tremendous market headroom for a new generation of companies fighting cryptocrime,” says Steve Morgan, founder and CEO at Cybersecurity Ventures.

– David Braue is an award-winning technology writer based in Melbourne, Australia.

Go here to read all of David’s Cybercrime Magazine articles.

About Evolution Equity

About Evolution EquityEvolution Equity Partners is an international venture capital investor partnering with exceptional entrepreneurs to develop market-leading cyber-security and enterprise software companies.

Based in New York City and Zurich, Switzerland, the firm is managed by investment and technology entrepreneurs who have built companies around the world and leverage their operating, technical and product development expertise to help entrepreneurs win.

Evolution has interest in companies utilizing big-data, machine learning, artificial intelligence, SaaS, mobile and the convergence of consumer and enterprise software to build leading information technology companies.

–

–